Malignant Pleural Mesothelioma Market Poised for Growth Across the 7MM During the Study Period (2020–2034) Amid Advances in Immunotherapy and Targeted Drugs | DelveInsight

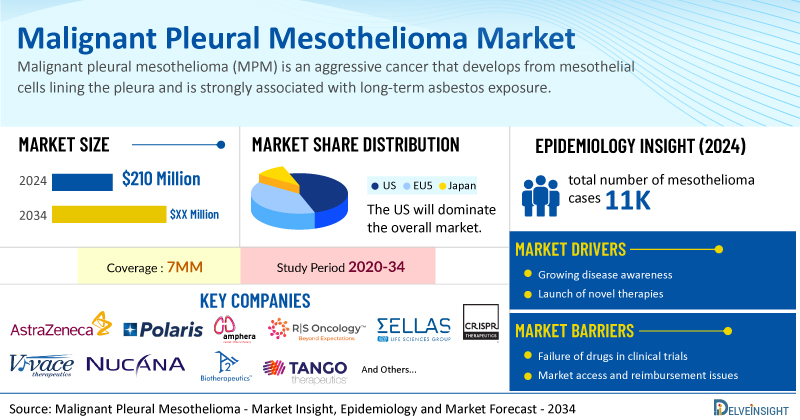

The malignant pleural mesothelioma market is poised for steady growth during the forecast period (2025–2034). The launch of innovative therapies by companies such as AstraZeneca, Polaris Pharmaceuticals, Amphera BV, RS Oncology, and others will drive this expansion across the 7MM.

/EIN News/ -- New York, USA, April 21, 2025 (GLOBE NEWSWIRE) -- Malignant Pleural Mesothelioma Market Poised for Growth Across the 7MM During the Study Period (2020–2034) Amid Advances in Immunotherapy and Targeted Drugs | DelveInsight

The malignant pleural mesothelioma market is poised for steady growth during the forecast period (2025–2034). The launch of innovative therapies by companies such as AstraZeneca, Polaris Pharmaceuticals, Amphera BV, RS Oncology, and others will drive this expansion across the 7MM.

DelveInsight’s Malignant Pleural Mesothelioma Market Insights report includes a comprehensive understanding of current treatment practices, emerging malignant pleural mesothelioma drugs, market share of individual therapies, and current and forecasted malignant pleural mesothelioma market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Malignant Pleural Mesothelioma Market Report

- According to DelveInsight’s analysis, the market size of malignant pleural mesothelioma was found to be USD 210 million in the 7MM in 2024.

- As per the estimates, among the currently marketed drugs currently in use, OPDIVO (Nivolumab) + YERVOY (Ipilimumab) held the largest market share, generating approximately USD 140 million in revenue in 2024 across the 7MM.

- According to DelveInsight’s estimates, in 2024, the total number of mesothelioma cases across the 7MM was around 11K. However, this figure is expected to decline by 2034, with a projected CAGR of 0.3%.

- Prominent companies working in the domain of malignant pleural mesothelioma, including AstraZeneca, Polaris Pharmaceuticals, Amphera BV, RS Oncology, Sellas Life Sciences Group, CRISPR Therapeutics AG, Vivace Therapeutics, NuCana plc, A2 Biotherapeutics, Tango Therapeutics, and others, are actively working on innovative Malignant Pleural Mesothelioma drugs. These novel malignant pleural mesothelioma therapies are anticipated to enter the malignant pleural mesothelioma market in the forecast period and are expected to change the market.

- Some of the key malignant pleural mesothelioma treatments include Volrustomig (MEDI5752), Pegargiminase with Pemetrexed and Cisplatin, MesoPher, Thiostrepton (RSO-021), alinpepimut-S, CTX131, VT3888, NUC-3373 (Fosifloxuridine Nafalbenamide), A2B694, TNG462, and others.

Discover which therapies are expected to grab the malignant pleural mesothelioma market share @ Malignant Pleural Mesothelioma Market Report

Malignant Pleural Mesothelioma Overview

Malignant pleural mesothelioma (MPM) is an aggressive cancer that develops from mesothelial cells lining the pleura and is strongly associated with long-term asbestos exposure. It is marked by rapid disease progression and a high mortality rate, primarily affecting older men decades after initial exposure. The disease's complexity, due to significant tumor heterogeneity, contributes to resistance to treatment and poses considerable management challenges. In an effort to improve diagnostic clarity, the 2021 WHO Classification of Thoracic Tumors (by IARC) updated its terminology—changing "diffuse malignant pleural mesothelioma" to "diffuse pleural mesothelioma" and "localized malignant pleural mesothelioma" to "localized pleural mesothelioma."

Asbestos remains the most prominent risk factor, with inhaled fibers causing chronic inflammation and long-term cellular damage. Other risk contributors include exposure to naturally occurring minerals like erionite, previous radiation therapy, and possible links to simian virus 40. Genetic predispositions—particularly BAP1 mutations—along with age and male sex also increase the likelihood of developing MPM.

Typical symptoms include shortness of breath and chest pain, often due to pleural effusion in the early stages or tumor encasement of the lungs in advanced disease. Systemic symptoms such as fatigue, weight loss, and general malaise are driven by cytokine release. Less commonly, tumor spread may lead to complications like superior vena cava syndrome or difficulty swallowing. In some cases, patients remain asymptomatic, highlighting the importance of regular monitoring for individuals with a history of asbestos exposure.

Diagnosis involves a combination of clinical assessment, imaging, and tissue analysis. CT and PET scans help detect pleural irregularities, but histopathological confirmation remains the definitive diagnostic method. Immunohistochemical markers support differentiation from other malignancies, while biomarkers like mesothelin show promise but lack sufficient accuracy for use alone. Accurate disease staging, often requiring invasive techniques, is crucial for effective treatment planning and prognosis estimation.

Malignant Pleural Mesothelioma Epidemiology Segmentation

The malignant pleural mesothelioma epidemiology section provides insights into the historical and current malignant pleural mesothelioma patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The malignant pleural mesothelioma market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of MPM

- Gender-specific Incident Cases of MPM

- Age-specific Incident Cases of MPM

- Histology-specific Incident Cases of MPM

- Stage-specific Incident Cases of MPM

- Line-wise Treated Cases of MPM

Download the report to understand which factors are driving malignant pleural mesothelioma epidemiology trends @ Malignant Pleural Mesothelioma Epidemiological Insights

Malignant Pleural Mesothelioma Treatment Market

The management of malignant pleural mesothelioma typically involves a multimodal approach, combining surgery, radiation therapy, and chemotherapy, with chemotherapy remaining the cornerstone of treatment. Due to the aggressive nature of MPM, surgical procedures are only feasible for a carefully selected group of patients, while radiotherapy is mainly employed for symptom control rather than curative intent. Chemotherapy—most commonly using pemetrexed, cisplatin, gemcitabine, and carboplatin—continues to be the most frequently used strategy.

Chemotherapy is divided into first-line and subsequent lines based on the disease stage and the patient’s response to prior treatments. However, each treatment modality presents limitations: surgery is an option for only a few patients, radiotherapy is palliative, and chemotherapy is often challenged by issues like resistance and recurrence. In light of these challenges, newer therapies—including targeted drugs and immunotherapies—have been developed to improve clinical outcomes and extend survival.

One such immunotherapy is KEYTRUDA (pembrolizumab), a PD-1 checkpoint inhibitor that enhances immune system activity by preventing PD-1 interactions, allowing T cells to recognize and destroy tumor cells. This humanized monoclonal antibody received U.S. FDA approval in September 2024 for use in combination with pemetrexed and platinum-based chemotherapy as a first-line treatment for adults with unresectable advanced or metastatic MPM, based on the KEYNOTE-483 trial, which demonstrated a significant survival benefit. It marked the first U.S. approval of KEYTRUDA for MPM. In November 2024, the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) also issued a positive opinion on the same regimen for first-line treatment of unresectable nonepithelioid MPM, and regulatory review is ongoing in Japan.

In addition, the combination of nivolumab and ipilimumab—two immune checkpoint inhibitors targeting PD-1 and CTLA-4 respectively—was approved by the U.S. FDA in October 2020 as a first-line treatment for unresectable MPM. This approval was based on results from the CHECKMATE 743 study, which demonstrated a significant survival benefit through immune system activation. OPDIVO (nivolumab), as a monotherapy, was approved in Japan in August 2018 for patients with unresectable, advanced, or recurrent MPM that progressed following chemotherapy, based on data from the Phase II MERIT trial, which confirmed its clinical benefit.

Learn more about the market of malignant pleural mesothelioma @ Malignant Pleural Mesothelioma Treatment

Malignant Pleural Mesothelioma Emerging Drugs and Companies

A significant progress has been made in understanding molecular pathogenesis and developing promising new therapeutic approaches for mesothelioma. Many different therapies have been attempted for malignant pleural mesothelioma over the years, including, immune therapy, gene therapy, and various combinations of investigational therapies. A few key players such as Astrazeneca (volrustomig), Amphera (mesopher), PrECOG (DuRvalumab), and others are under early to mid-stage clinical development.

Volrustomig (MEDI5752) is an innovative bispecific antibody developed to boost anti-tumor immune responses by simultaneously targeting PD-1 and CTLA-4 checkpoints. This dual-action design seeks to enhance immune activation against tumors while potentially reducing the side effects commonly seen with combination immunotherapies. A Phase III clinical trial is currently underway to assess its safety and effectiveness in combination with carboplatin and pemetrexed for patients with unresectable MPM.

This study is comparing volrustomig-based therapy with standard platinum chemotherapy and with the combination of nivolumab and ipilimumab as a first-line treatment, with results anticipated post-2026. In April 2022, AstraZeneca introduced findings from the first-in-human trial of MEDI5752 at the American Association for Cancer Research (AACR) annual meeting, highlighting its potential as a novel bispecific immune checkpoint inhibitor for advanced solid tumors.

Pegargiminase (ADI-PEG 20) is a pioneering enzyme-based therapy designed to deprive certain cancers of arginine—an amino acid some tumors rely on for growth and survival. By converting arginine into citrulline and ammonia, it interrupts protein synthesis, thereby selectively inducing cancer cell death. It is currently being evaluated in the Phase III ATOMIC-Meso trial in combination with chemotherapy for patients with nonepithelioid pleural mesothelioma. Based on positive data showing improvements in progression-free and overall survival, a rolling regulatory submission is underway, which could potentially expedite its approval.

According to the JP Morgan Healthcare Conference held in January 2024, Polaris Pharma planned to submit a Marketing Authorization Application (MAA) for Pegargiminase in Europe within the year. However, there have been no recent updates on the status of this submission. The company is also aiming for a commercial launch in 2025.

MesoPher, developed by Amphera BV, is an autologous dendritic cell-based immunotherapy aimed at triggering a targeted anti-tumor immune response. It utilizes a patient’s own dendritic cells, which are loaded with the PheraLys lysate to improve antigen presentation. Following leukapheresis and activation, the modified cells are reinfused to stimulate the immune system—potentially transforming immunologically “cold” tumors into “hot” ones that are more responsive to treatment. Now in Phase III trials, MesoPher has demonstrated encouraging immunogenicity and a favorable safety profile. In June 2024, findings from the randomized Phase II/III MesoPher trial for pleural mesothelioma were published in The Lancet Oncology, highlighting the therapy’s clinical potential.

Other therapies in the pipeline for MPM include

- Thiostrepton (RSO-021): RS Oncology

- Galinpepimut-S: Sellas Life Sciences Group

- CTX131: CRISPR Therapeutics AG

- VT3888: Vivace Therapeutics

- NUC-3373 (Fosifloxuridine Nafalbenamide): NuCana plc

- A2B694: A2 Biotherapeutics

- A2B694: A2 Biotherapeutics

The anticipated launch of these emerging therapies are poised to transform the malignant pleural mesothelioma market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the malignant pleural mesothelioma market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about malignant pleural mesothelioma clinical trials, visit @ Malignant Pleural Mesothelioma Treatment Drugs

Malignant Pleural Mesothelioma Market Dynamics

The malignant pleural mesothelioma market dynamics are anticipated to change in the coming years. MPM presents unique market dynamics shaped by both clinical and legal factors. Many MPM patients have legal claims due to asbestos exposure, which often provides them with financial resources to cover the cost of treatments and supportive services, potentially easing access to premium-priced therapies.

The clinical pipeline for MPM is robust, featuring a range of innovative therapies under development with diverse mechanisms of action, including gene therapies, immunotherapies, arginine-degrading enzymes, and PD-L1 inhibitors. Promising pipeline candidates like MesoPher and others have received Orphan Drug Designation (ODD), which offers key regulatory incentives such as seven years of market exclusivity in the U.S., reduced regulatory fees, and clinical trial subsidies—enhancing the commercial viability of these therapies.

Moreover, advancements in blood-based biomarkers are opening new avenues in MPM management, with potential applications in diagnostics, prognosis, and predicting treatment response. These developments support a more personalized approach to care and may further differentiate emerging therapies. As a result, companies with therapies that demonstrate a clear clinical advantage over current standards like nivolumab could justify premium pricing, positioning themselves competitively in a high-need, specialized market.

Furthermore, many potential therapies are being investigated for the treatment of malignant pleural mesothelioma, and it is safe to predict that the treatment space will significantly impact the malignant pleural mesothelioma market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the malignant pleural mesothelioma market in the 7MM.

However, several factors may impede the growth of the malignant pleural mesothelioma market. MPM is typically diagnosed at an advanced stage due to its nonspecific symptoms—such as chest pain and shortness of breath—and the lack of effective early detection methods. This delayed diagnosis contributes to a poor prognosis, with median survival ranging from just 7 to 12 months. While chemotherapy and radiation remain standard treatments, they are often associated with significant side effects, including fatigue and general weakness, which greatly diminish patients’ quality of life. Common regimens like cisplatin and pemetrexed provide only modest survival benefits, typically extending life by approximately three months.

Given the limited efficacy of existing therapies, healthcare authorities are likely to scrutinize the pricing and usage of new high-cost treatments that do not clearly outperform current standards. Furthermore, while legal settlements and financial support offer access advantages for some patients, the overall incidence of MPM is on the decline in most of the 7MM—with the exception of Spain and Japan—leading to a shrinking eligible patient population for emerging therapies. These factors underscore the importance of demonstrating significant clinical value and cost-effectiveness for any new entrants in the MPM treatment landscape.

Moreover, malignant pleural mesothelioma treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the malignant pleural mesothelioma market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the malignant pleural mesothelioma market growth.

| Malignant Pleural Mesothelioma Report Metrics | Details |

| Study Period | 2020–2034 |

| Malignant Pleural Mesothelioma Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Malignant Pleural Mesothelioma Market CAGR | 0.7% |

| Malignant Pleural Mesothelioma Market Size in 2024 | USD 210 Million |

| Key Malignant Pleural Mesothelioma Companies | AstraZeneca, Polaris Pharmaceuticals, Amphera BV, RS Oncology, Sellas Life Sciences Group, CRISPR Therapeutics AG, Vivace Therapeutics, NuCana plc, A2 Biotherapeutics, Tango Therapeutics, and others |

| Key Malignant Pleural Mesothelioma Therapies | Volrustomig (MEDI5752), Pegargiminase with Pemetrexed and Cisplatin, MesoPher, Thiostrepton (RSO-021), alinpepimut-S, CTX131, VT3888, NUC-3373 (Fosifloxuridine Nafalbenamide), A2B694, TNG462, and others |

Scope of the Malignant Pleural Mesothelioma Market Report

- Malignant Pleural Mesothelioma Therapeutic Assessment: Malignant Pleural Mesothelioma current marketed and emerging therapies

- Malignant Pleural Mesothelioma Market Dynamics: Conjoint Analysis of Emerging Malignant Pleural Mesothelioma Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Malignant Pleural Mesothelioma Market Access and Reimbursement

Discover more about malignant pleural mesothelioma drugs in development @ Malignant Pleural Mesothelioma Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | MPM Market Overview at a Glance |

| 3.1 | Market Share (%) Distribution of MPM by Therapies in the 7MM in 2020 |

| 3.2 | Market Share (%) Distribution of MPM by Therapies in the 7MM in 2034 |

| 4 | Executive Summary |

| 5 | Key Events |

| 6 | Disease Background and Overview |

| 6.1 | Introduction |

| 6.2 | Types of MPM |

| 6.3 | Signs and Symptoms |

| 6.4 | Risk Factors and Causes |

| 6.5 | Pathophysiology |

| 6.6 | Diagnosis |

| 6.6.1 | Differential Diagnosis |

| 6.6.2 | Diagnostic Algorithm |

| 6.6.3 | Diagnostic Guidelines and Recommendations |

| 6.7 | Treatment and Management |

| 6.7.1 | Treatment Algorithm |

| 6.7.2 | Treatment Guidelines and Recommendations |

| 7 | Epidemiology and Market Methodology |

| 8 | Epidemiology and Patient Population |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationale: 7MM |

| 8.2.1 | Incidence of Mesothelioma |

| 8.2.2 | Incidence of MPM in Mesothelioma |

| 8.2.3 | Gender-specific Incidence of MPM |

| 8.2.4 | Age-specific Incidence of MPM |

| 8.2.5 | Histology-specific Incidence of MPM |

| 8.2.6 | Stage-specific Incidence of MPM |

| 8.3 | Total Incident Cases of Mesothelioma in the 7MM |

| 8.4 | Total Incident Cases of MPM in the 7MM |

| 8.5 | The United States |

| 8.5.1 | Total Incident Cases of MPM in the US |

| 8.5.2 | Gender-specific Incident Cases of MPM in the US |

| 8.5.3 | Age-specific Incident Cases of MPM in the US |

| 8.5.4 | Histology-specific Incident Cases of MPM in the US |

| 8.5.5 | Stage-specific Incident Cases of MPM in the US |

| 8.5.6 | Line-wise Treated Cases of MPM in the US |

| 8.6 | EU4 and the UK |

| 8.6.1 | Total Incident Cases of MPM in EU4 and the UK |

| 8.6.2 | Gender-specific Incident Cases of MPM in EU4 and the UK |

| 8.6.3 | Age-specific Incident Cases of MPM in EU4 and the UK |

| 8.6.4 | Histology-specific Incident Cases of MPM in EU4 and the UK |

| 8.6.5 | Stage-specific Incident Cases of MPM in EU4 and the UK |

| 8.6.6 | Line-wise Treated Cases of MPM in EU4 and the UK |

| 8.7 | Japan |

| 8.7.1 | Total Incident Cases of MPM in Japan |

| 8.7.2 | Gender-specific Incident Cases of MPM in Japan |

| 8.7.3 | Age-specific Incident Cases of MPM in Japan |

| 8.7.4 | Histology-specific Incident Cases of MPM in Japan |

| 8.7.5 | Stage-specific Incident Cases of MPM in Japan |

| 8.7.6 | Line-wise Treated Cases of MPM in Japan |

| 9 | Patient Journey |

| 10 | Marketed Therapies |

| 10.1 | Key Cross of Marketed Drugs |

| 10.2 | KEYTRUDA (Pembrolizumab): Merck |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestone |

| 10.2.3 | Other Developmental Activities |

| 10.2.4 | Clinical Trials Information |

| 10.2.5 | Safety and Efficacy |

| 10.3 | OPDIVO (Nivolumab) and YERVOY (Ipilimumab): Bristol-Myers Squibb/Ono Pharmaceuticals |

| 10.3.1 | Product Description |

| 10.3.2 | Regulatory Milestone |

| 10.3.3 | Other Developmental Activities |

| 10.3.4 | Clinical Trials Information |

| 10.3.5 | Safety and Efficacy |

| 10.4 | OPDIVO (Nivolumab): Bristol-Myers Squibb/Ono Pharmaceuticals |

| 10.4.1 | Product Description |

| 10.4.2 | Regulatory Milestone |

| 10.4.3 | Other Developmental Activities |

| 10.4.4 | Clinical Trials Information |

| 10.4.5 | Safety and Efficacy |

| 10.5 | OPTUNE LUA: Novocure |

| 10.5.1 | Product Description |

| 10.5.2 | Regulatory Milestone |

| 10.5.3 | Other Developmental Activities |

| 10.5.4 | Clinical Trials Information |

| 10.5.5 | Safety and Efficacy |

| To be continued in the report… | |

| 11 | Emerging Drug Profiles |

| 11.1 | Key Cross Competition of Emerging Drugs |

| 11.2 | Volrustomig (MEDI5752): AstraZeneca |

| 11.2.1 | Drug Description |

| 11.2.2 | Other Developmental Activities |

| 11.2.3 | Clinical Trials Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analysts’ Views |

| 11.3 | Pegargiminase with Pemetrexed and Cisplatin: Polaris Pharmaceuticals |

| 11.3.1 | Drug Description |

| 11.3.2 | Other Developmental Activities |

| 11.3.3 | Clinical Trials Information |

| 11.3.4 | Safety and Efficacy |

| 11.3.5 | Analysts’ Views |

| 11.4 | MesoPher: Amphera BV |

| 11.4.1 | Drug Description |

| 11.4.2 | Other Developmental Activities |

| 11.4.3 | Clinical Trials Information |

| 11.4.4 | Safety and Efficacy |

| 11.4.5 | Analysts’ Views |

| 11.5 | Thiostrepton (RSO-021): RS Oncology |

| 11.5.1 | Drug Description |

| 11.5.2 | Other Developmental Activities |

| 11.5.3 | Clinical Trials Information |

| 11.5.4 | Safety and Efficacy |

| 11.5.5 | Analysts’ Views |

| 11.6 | Galinpepimut-S: Sellas Life Sciences Group |

| 11.6.1 | Drug Description |

| 11.6.2 | Other Developmental Activities |

| 11.6.3 | Clinical Trials Information |

| 11.6.4 | Safety and Efficacy |

| 11.6.5 | Analysts’ Views |

| 11.7 | CTX131: CRISPR Therapeutics AG |

| 11.7.1 | Drug Description |

| 11.7.2 | Other Developmental Activities |

| 11.7.3 | Clinical Trials Information |

| 11.7.4 | Safety and Efficacy |

| 11.7.5 | Analysts’ Views |

| 11.8 | VT3888: Vivace Therapeutics |

| 11.8.1 | Drug Description |

| 11.8.2 | Other Developmental Activities |

| 11.8.3 | Clinical Trials Information |

| 11.8.4 | Safety and Efficacy |

| 11.8.5 | Analysts’ Views |

| 11.9 | NUC-3373 (Fosifloxuridine Nafalbenamide): NuCana plc |

| 11.9.1 | Drug Description |

| 11.9.2 | Other Developmental Activities |

| 11.9.3 | Clinical Trials Information |

| 11.9.4 | Safety and Efficacy |

| 11.9.5 | Analysts’ Views |

| 11.10 | A2B694: A2 Biotherapeutics |

| 11.10.1 | Drug Description |

| 11.10.2 | Other Developmental Activities |

| 11.10.3 | Clinical Trials Information |

| 11.10.4 | Safety and Efficacy |

| 11.10.5 | Analysts’ Views |

| 11.11 | TNG462: Tango Therapeutics |

| 11.11.1 | Drug Description |

| 11.11.2 | Other Developmental Activities |

| 11.11.3 | Clinical Trials Information |

| 11.11.4 | Safety and Efficacy |

| 11.11.5 | Analysts’ Views |

| To be continued in the report… | |

| 12 | MPM |

| 12.1 | Key Findings |

| 12.2 | Market Outlook |

| 12.3 | Attribute Analysis |

| 12.4 | Key Market Forecast Assumptions |

| 12.4.1 | Cost Assumptions and Rebates |

| 12.4.2 | Pricing Trends |

| 12.4.3 | Analogue Assessment |

| 12.4.4 | Launch Year and Therapy Uptake |

| 12.5 | Total Market Size of MPM in the 7MM |

| 12.6 | Market Size of MPM by Therapies in the 7MM |

| 12.7 | Market Size of MPM in the United States |

| 12.7.1 | Total Market Size of MPM |

| 12.7.2 | Market Size of MPM by Therapies in the United States |

| 12.8 | Market Size of MPM in EU4 and the UK |

| 12.8.1 | Total Market Size of MPM |

| 12.8.2 | Market Size of MPM by Therapies in EU4 and the UK |

| 12.9 | Market Size of MPM in Japan |

| 12.9.1 | Total Market Size of MPM |

| 12.9.2 | Market Size of MPM by Therapies in Japan |

| 13 | Key Opinion Leaders’ Views |

| 14 | Unmet Needs |

| 15 | SWOT Analysis |

| 16 | Market Access and Reimbursement |

| 16.1 | The United States |

| 16.1.1 | CMS |

| 16.2 | In EU4 and the UK |

| 16.2.1 | Germany |

| 16.2.2 | France |

| 16.2.3 | Italy |

| 16.2.4 | Spain |

| 16.2.5 | The United Kingdom |

| 16.3 | Japan |

| 16.3.1 | MHLW |

| 17 | Appendix |

| 17.1 | Acronyms and Abbreviations |

| 17.2 | Bibliography |

| 17.3 | Report Methodology |

| 18 | DelveInsight Capabilities |

| 19 | Disclaimer |

| 20 | About DelveInsight |

Related Reports

Malignant Pleural Mesothelioma Pipeline

Malignant Pleural Mesothelioma Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key malignant pleural mesothelioma companies, including MolMed, PharmaMar, Ys Therapeutics, Merck Sharp & Dohme Corp., Kissei Pharmaceutical Co., Ltd., NovoCure Ltd, AGC Biologics S.p.A, Aduro Biotech, Inc, Novartis, Bristol-Myers Squibb, Novartis, TCR2 Therapeutics, Novotech (Australia) Pty Limited, AstraZeneca, Hoffmann-La Roche, Polaris Pharmaceuticals, Kyorin Pharmaceuticals, ACADIA Pharmaceuticals, among others.

Malignant Pleural Mesothelioma Epidemiology Forecast

Malignant Pleural Mesothelioma Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted malignant pleural mesothelioma epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Mesothelioma Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key mesothelioma companies including Polaris Pharmaceuticals, AstraZeneca, MedImmune LLC, Takeda, RS Oncology LLC, Vivace Therapeutics, Inc, VM Oncology, LLC, KaliVir Immunotherapeutics, UTC Therapeutics Inc., Tango Therapeutics, Inc., Verismo Therapeutics, SpringWorks Therapeutics, Inc., Gilead Sciences, Nurix Therapeutics, Inc., Amphera BV, Merck Sharp & Dohme LLC, Constellation Pharmaceuticals, BridGene Biosciences Inc., Aromics Therapeutics, Ascentage Pharma Group Inc., 7 Hills Pharma, LLC, among others.

Mesothelioma Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key mesothelioma companies, including Polaris Pharmaceuticals, AstraZeneca, MedImmune LLC, Takeda, RS Oncology LLC, Vivace Therapeutics, Inc, VM Oncology, LLC, KaliVir Immunotherapeutics, UTC Therapeutics Inc., Tango Therapeutics, Inc., Verismo Therapeutics, SpringWorks Therapeutics, Inc., Gilead Sciences, Nurix Therapeutics, Inc., Amphera BV, Merck Sharp & Dohme LLC, Constellation Pharmaceuticals, BridGene Biosciences Inc., Aromics Therapeutics, Ascentage Pharma Group Inc., 7 Hills Pharma, LLC, among others.

Malignant Mesothelioma Pipeline

Malignant Mesothelioma Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key malignant mesothelioma companies, including Epizyme, Ys Therapeutics, Novartis, Bayer, RS Oncology, Polaris Pharmaceuticals, Merck, Vivace Therapeutics, Shionogi, Mirati Therapeutics, Incyte Corporation, TCR2 Therapeutics, SOTIO Biotech, Pfizer, Ascentage Pharma, Fida Farmaceutici, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

www.delveinsight.com

Distribution channels: Healthcare & Pharmaceuticals Industry, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release